(Reprinted from HKCER Letters, Vol. 64, March/April 2001)

Hong Kong's Fiscal Issues

Y.C. Richard Wong

Is There a Structural Budget Deficit in Hong Kong?

Government officials have expressed concerns about the volatility of the Hong Kong's fiscal revenue, in particular the fact that recurrent fiscal revenue is falling short of recurrent spending. Fears that the Hong Kong's fiscal financial position is suffering from a structural deficit were exacerbated by the Asian financial crisis. The fiscal deficits were 1.9 and 0.9 percent of GDP in 1998/99 and 2000/01 respectively.

For years, many groups have pushed to broaden the tax base as a solution to Hong Kong's problems of volatility and structural budget deficits. A task force on broadening the tax base was created to study the issue and to recommend solutions. These problems are not unique to Hong Kong. Many countries face similar dilemmas.

The classical structural deficit problem emerges when an economy at the natural rate of unemployment experiences a fiscal deficit. It is normal for deficits to rise and fall over the business cycle, because fiscal revenue is in general more volatile than fiscal spending to economic fluctuations. Therefore, if the fiscal budget is balanced at the natural rate of unemployment there is no long-term budget deficit problem that is structural in nature; there are only temporary deficits resulting from the business cycle. The latter problems are short term in nature and disappear as the economy recovers.

Structural budget deficits arise because fiscal revenue grows at a lower rate than fiscal expenditure in the long run. In other words, the problem is one of perennial overspending or of living beyond one's means.

Usually this problem arises because it is politically difficult to lower the demand for expenditure growth and to raise revenue to match governments' tendency to spend more and more. Almost all political systems, democracies included, have this problem. Fortunately for Hong Kong, the Basic Law provides a kind of constitutional constraint limit on budget deficits.

Another reason that public spending tends to rise faster than revenue stems from the fact that the most important component of public spending is civil service remuneration. Professor William Baumol has argued that efficiency gains in this sector typically lag behind the rest of the economy; as a consequence, the cost of delivering the same level of service demanded by society becomes increasingly costly. Hence, public spending in general increases faster than economic growth. To hold down public spending therefore requires a conscious decision to move public spending activities into the private sector.

Hong Kong's experience in the past 20 years indicates that revenue exceeded spending during certain periods but that the opposite was true in others.

Sometimes, volatility can mask what is essentially a structural issue. In a good year, when revenue increases, so does spending. In a bad year, however, spending does not decrease even when revenue does. If spending always grew to match growth in revenue, over time, spending would exceed revenue. Thus, volatility is really a structural imbalance between spending and revenue.

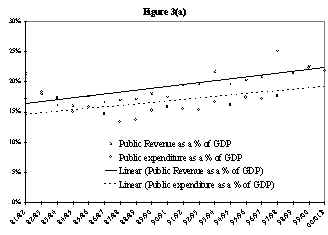

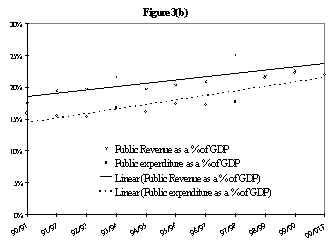

When we smooth out revenue and spending data in Hong Kong, it appears that volatility is not the problem. Smoothing reveals a divergence between spending and revenue. We apply three different definitions to measure the tax and spending trend rates as follows.

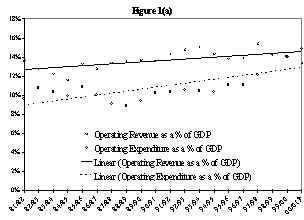

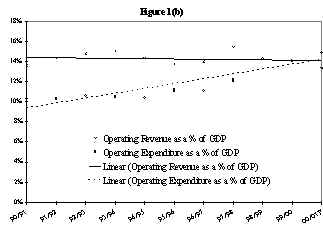

- Operating revenue and operating expenditure as percentages of GDP1 ;

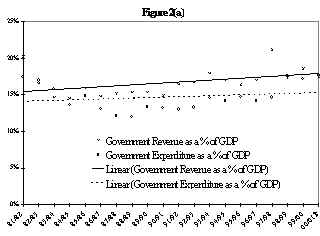

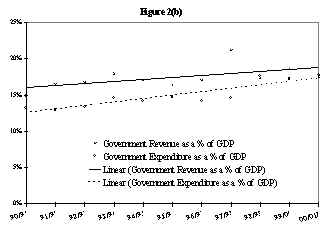

- Government revenue and government expenditure as percentages of GDP2 ;

- Public revenue and public expenditure as percentages of GDP3 .

An examination of the tax and spending trend rates4 in the two periods 1990/01-2000/01 and 1981/82-2000/01 reveals that our propensity to spend is growing at a faster rate than our ability to raise revenue in the more recent period, but the evidence is more mixed for the longer period (see Figures 1-3). The most alarming result is that the growth of operating expenditure has been rising faster than operating revenue throughout the past two decades. In other words, recurrent spending is growing faster than recurrent revenue.

These figures also reflect another result of concern and that is public expenditure has been rising faster than government expenditure in the past two decades. In other words, as government activities are reorganized and delivered through non-government publicly subvented organizations, total spending has been increasing at an even faster rate. This no doubt reflects the nature of the activities that have been shifted out of the government sector into the non-government public sector. Nevertheless the rise of total public spending is an issue of concern because it implies that an increasing proportion of society's resources are now controlled and allocated in the public domain.

In my view, the rising share of public expenditure in GDP and the faster growth of recurrent spending over recurrent revenue are the main structural problems of our budget.

The Challenges of Globalization

In a global economy, changes in the tax rate in one country trigger capital flows to and from other countries. If we do not maintain a competitive tax regime we will lose business because capital is internationally mobile. This is becoming more important in the global world. With increasing capital and human capital mobility, government revenue obtained from domestic residents will become more and more endogenous.

An increasingly large share of Hong Kong's income comes from overseas. Indeed, gross domestic product (GDP) may not be a good measure of our current economic performance. In the past decade, GDP has been more volatile than consumption, although this is less evident in periods before the past decade. This is unusual. In most countries, GDP tends to rise faster than consumption in economic upswings and to fall faster in business downswings. But in Hong Kong, the opposite is true. As an increasingly large share of our income is earned outside Hong Kong, GDP becomes a poor approximation of gross national product (GNP). This mismatch implies profound long-term budget implications.

In Hong Kong, fiscal revenue is derived from economic activities performed within the territory. As an increasing proportion of income comes from outside Hong Kong, the revenue base becomes a smaller part of Hong Kong's regionalized economy. However, Hong Kong residents continue to demand public expenditure. This sets the stage for revenue growth to fall short of expenditure growth and gives rise to a widening gap between expenditure and revenue. This gap represents another possible source of the structural deficit Hong Kong may be facing.

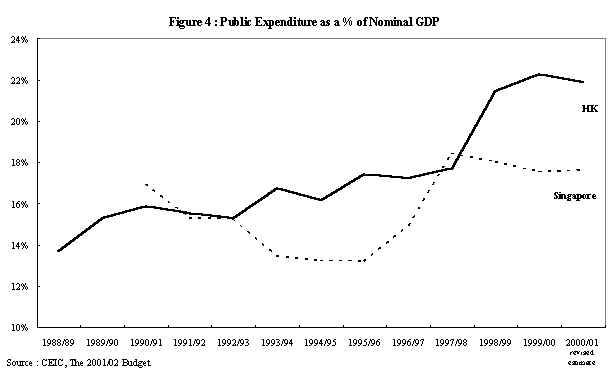

Is the Hong Kong Government Limited?We have always considered our government limited and have compared ourselves favorably against Singapore in this regard. It is interesting to note that in the past decade, Hong Kong's public expenditure as a percentage of GDP has been growing faster than Singapore's (see Figure 4). There are obvious differences between Singapore's and Hong Kong's definitions of public expenditure. (For example, expenditure financed indirectly by the Central Provident Fund in Singapore is not reported as public expenditure.) Nevertheless, the figures still demonstrate that the trends in the two city economies' public expenditures have been different. It is unlikely that our government is still limited in this sense.

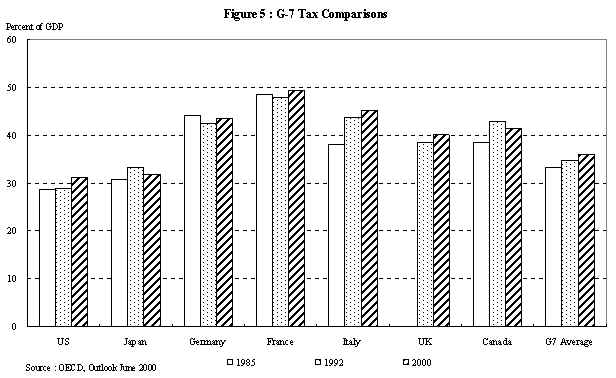

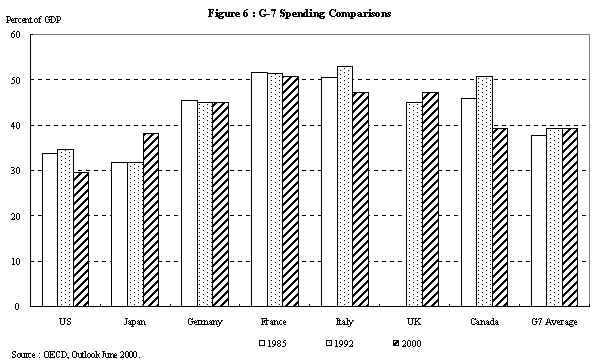

Revenue and Spending: International ComparisonsIt is interesting to compare the experience of various countries' tax collecting and spending capacities over the past 15 years. It is particular noteworthy that tax collection as a percentage of GDP in most G7 countries has been rising on the whole (see Figure 5). In the United States, revenue as a percentage of GDP has risen quite rapidly during the past decade. The governments in most G7 countries have enhanced their ability to collect more taxes. However, spending as a percentage of GDP in a number of G7 countries, like the United States, Italy, and Canada, is declining (see Figure 6). Budget surpluses are the result of both a robust economy and the ability to cut spending. To balance the budget or to generate surpluses one must work not only on the revenue side but also on the spending side.

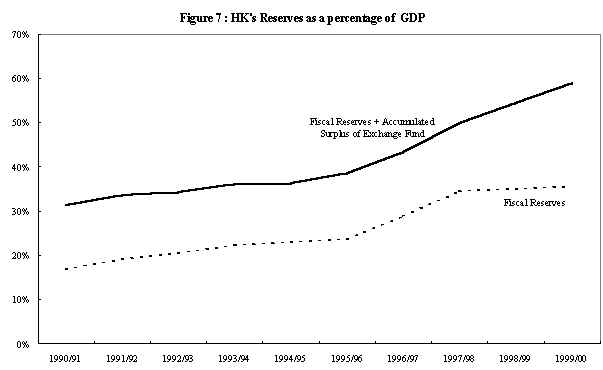

Fiscal Reserves are GrowingHong Kong is unique. Its accumulated fiscal reserves as a percentage of GDP are rising (see Figure 7). Total reserves are also steadily growing, thanks to our intervention in the stock market that has proven be highly profitable and also to the enormous contribution from land sales effected as a result of the property price boom of 1986-97. The growth rate leveled off after the Asian financial crisis.

The presence of such large reserves presents the government with an interesting choice of methods by which to address the issue of possible structural fiscal deficits. First, it could attempt to raise revenue either by raising tax rates or by broadening the tax base. Second, it could deploy fiscal reserves to pay off affected parties so as to soften the political fallout from cutting future public spending. A variation of the second choice would be for the government to privatize various productive assets to generate revenue and to produce better returns on its asset value.

What is Wrong with Broadening the Tax Base?It would seem that Hong Kong's problem is the rapid expansion of government spending, not unstable revenue. Broadening the tax base is a superficial solution to the problem of rising public expenditure.

Broadening the tax base is economically sound because doing so lowers economic distortion of incentives and enables the government to collect a large amount of tax revenue at a low tax rate. However, broadening the tax base is politically hazardous. Few governments remain in power after introducing broad-based taxes. Broadening the tax base may be criticized on political economy grounds for making it easier for the government to raise funds to finance spending increases. As a consequence, broadening the tax base is likely to make cutting public spending less imminent.

A popular proposal for broadening Hong Kong's tax base is to introduce consumption taxes. One advantage of consumption taxes is that they do not affect investments. Consumption taxes are the least costly form of taxation and, appropriately applied, are a good substitute for income taxes, but they are rarely applied in this way. More often, they simply become an additional tax. For this reason, consumption taxes are often perceived as a bid to raise taxes rather than as a measure to reform taxes.

The main problems with consumption taxes are as follows:

They cascade, unless they are applied as a value-added tax, which is cumbersome to administer.

They tax exports, especially exports of services.

The temptation to adopt different tax rates for different forms of consumption seems irresistible in an open political system.

Broadening is always regressive and politically incorrect.

In Hong Kong, introducing new taxes to balance the budget at a time when the economy is beginning to recover from recession is unwise because doing so may have a dampening effect on the economy, particularly at this juncture when world economic prospects are uncertain.

The Solution: Run Down Fiscal Reserves to Lower Recurrent SpendingIn my mind, the burning question in Hong Kong is, what is the optimal level of government spending? The issue is that of determining the best means by which to assign the public sector and the private sector responsibility for different activities. There is a vast literature documenting in detail why downsizing public spending leads to greater overall economic efficiency and enhances economic prospects for all in the long run.

In my view, there is considerable room for the government to cut public spending. To do so, however, would be politically painful. Fortunately Hong Kong has a substantial fiscal reserve that could be leveraged to make expenditure cutting more palatable to society and to directly affected parties. Expenditure cutting would help preserve Hong Kong's commitment to limited government. It would also help us deal with the budget structural deficits that we are likely to face.

There are many concrete things we can do. Some would be more difficult to do than others, but all are worth considering.

We can fully fund civil service pensions, which will then be removed from recurrent public expenditure. Expenditure on civil servants’ pensions is a big part of recurrent public expenditure. An accrual-based accounting approach to budgeting would help us formulate a more accurate picture of what is to be gained by putting into place such a measure.

We can reform our public housing policy and end the Home Ownership Scheme program. This would pave the way for a more rational housing policy based on enlarging the private market. It would not only enhance economic efficiency but also enhance government revenue.

We can privatize many government-owned assets, like the Airport Authority, the Water Authority, and tunnels.

We can increase private participation in infrastructure development projects. Capital spending could thus be lowered.

We can enhance incentives for the private provision and funding of health care to stem the growth of public medical and health expenditures that are likely to rise exponentially as our population ages.

We can endow universities and reduce recurrent spending on education as a means by which to enhance the quality of our universities.

These are ways of moving spending out of the public domain and of enhancing Hong Kong's economic efficiency and competitiveness as a whole. These measures could significantly lower public spending and raise public revenue. Implementing them would not be easy. But our enormous accumulated fiscal reserve would help cushion the political fallout. This reserve provides Hong Kong with a unique opportunity to lower recurrent spending by transferring recurrent public sector activities into the private domain.

Notes:

1

The expenditure and revenue of the Operating Account to those of the Government's GRA and Funds Accounts are around to be 70% and 80% respectively. Some 60% of total operating expenditure comes from employee's salaries and related expenses of the government departments and non-departmental public bodies.2

Government Revenue and Government Expenditure are the Revenue and Expenditure of the Government's Consolidated Account (GRA and Funds). The Consolidated Account is consolidated by the General Revenue Account and the accounts of Capital Work Reserve Fund, Capital Investment Fund, Civil Service Pension Reserve Fund, Disaster Relief Fund, Innovation and Technology Fund, Land Fund and Loan Fund. These accounts are included in the Government's Annual Estimates and appropriations are approved each year to meet their anticipated cash expenditure requirements. However, Government Expenditure excludes advances and equity investments from Capital Investment Fund as they do not reflect the actual consumption of resources by the Government.3

Public expenditure, also known as Consolidated Public Sector expenditure, includes government expenditure, total expenditure of five trading funds, the Housing Authority and the previous Provisional Urban and Regional Councils (up to 31 December 1999), and payments from the Lotteries Fund. Public Revenue is roughly estimated by using the same coverage and deducting incomes transferred from the Government.4

Tax rate: revenue as a percentage of nominal GDP. Spending rate: spending as a percentage of nominal GDP.

| Index | Research Projects | HKCER Letters |

| Speaker Program / Conference | Index of Economic Freedom |The Hong Kong Centre for Economic Research

School of Economics and Finance

The University of Hong Kong

Phone: (852) 2547-8313 Fax: (852) 2548-6319

email: hkcer@econ.hku.hk