(Reprinted from HKCER Letters, Vol.63, January/February 2001)

Examining the Hong Kong Government Budget and Fiscal Reserves from a Macroeconomic Perspective

Paul Lau

Introduction

In this paper, I will focus on certain macroeconomic aspects of fiscal policy in Hong Kong. Specifically, I will look at some data relevant to the Hong Kong's government's budget, as well as at the fiscal reserves, which in essence represent the cumulative effect of past budget surpluses and deficits.

Building from these data, I will then share with you some lessons I have learned and some insights I have formed on several interesting issues. I will conclude by highlighting certain key points, including the implications of my observations for Hong Kong's fiscal policy.

Facts and FiguresAs an empirical macroeconomist, my inclination is to look at data first.

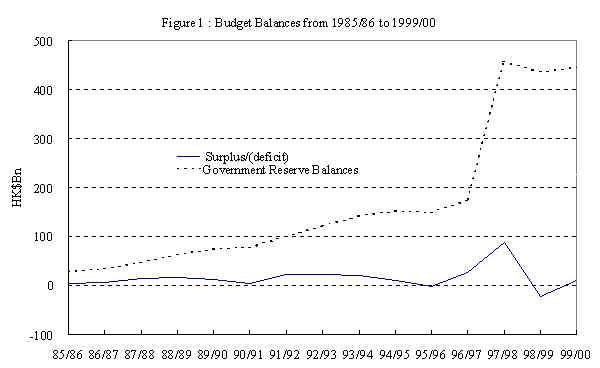

Figure 1 shows Hong Kong's consolidated budget balances, expressed in nominal terms, for the last 15 years or so.

The figure illustrates the fact that Hong Kong has been experiencing budget surpluses during most of the last 15 years, with the exception of financial year 1995/96 and, more dramatically, financial year 1998/99, in which there was a HK$23 billion deficit. Because the number of years in which there have been surpluses exceed the number in which there have been deficits, fiscal reserves have increased steadily over the past decade and a half. There was a large one-time increase in fiscal reserves in financial year 1996/97, when the Land Fund was transferred to the Hong Kong Special Administrative Region government. In addition, there has been a high degree of volatility in recent years, starting from financial year 1996/97.

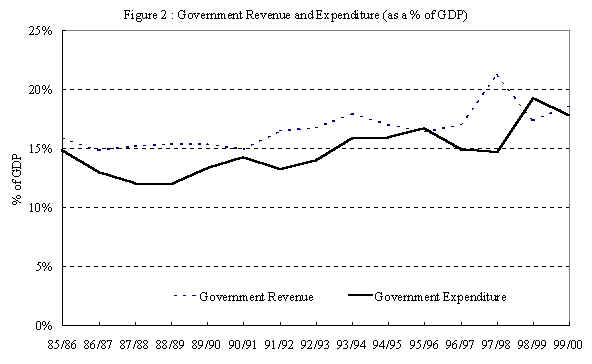

Moving from the consolidated budget balance, Figure 2 helps us understand the changing patterns of revenue and expenditure that make up the budget balances. Government revenues and expenditures are expressed as a percentage of GDP so as to adjust for the effect of economic growth and inflation over an extended time period. From Figure 2, one can see that both the revenue-to-GDP and the expenditure-to-GDP ratios increase slightly over time. Again, there has been a high degree of volatility in the recent years, particularly for revenue.

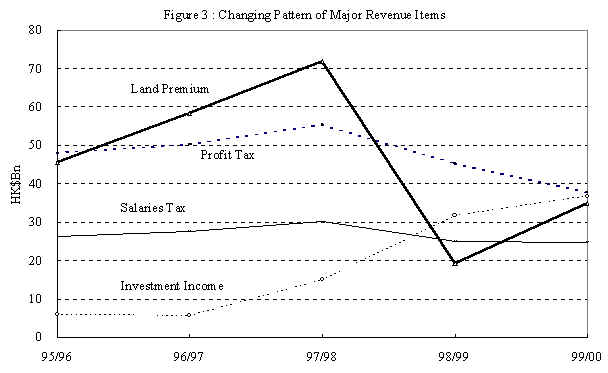

Figure 3 shows the movement of major government revenue items in recent years. As you may be aware, the four items (namely, profit tax, salaries tax, land premium, and investment income from fiscal reserves) amount to 60% or more of total government revenue in the past few years. From Figure 3, we can see that, while both profit and salaries taxes have undergone a certain degree of cyclical downturn in recent years owing to the Asian economic crisis, the decline in land premium has been even more dramatic. Offsetting the decline in revenue and giving Hong Kong's budget balance a big boost in the past two financial years has been the increase in investment income from fiscal reserves. Investment income constituted about 20% of Hong Kong's revenues in the last two financial years.

So what can we learn from these facts and figures?

Is There a Structural Deficit?Around town, heated debates are raging as to whether Hong Kong's budget contains a structural deficit. Before we jump into the fray, let's look at what "structural deficit" means. Structural deficit is a measure of what the government deficit would be under existing tax and spending rules, if GDP were at its "natural" (or mid-cycle) level. In other words, business cycle effects on the budget are filtered out. Structural deficit is also known as "full-employment" deficit, mid-cycle deficit, or cyclically adjusted deficit.

While it is very important to determine whether our government has structural problems that require policy remedies, we have to understand the inherent difficulties in determining whether a structural deficit in fact exists.

In identifying what the deficit would be if the economy were at the natural or mid-cycle levels, we have to use sophisticated methods to isolate the cyclical component from the trend growth component. Moreover, the determination is based on the assumption that historical trends can predict future movements.

But given the extraordinary budgetary and economic pattern we have experienced in recent years (and also given the volume of discussion about the possible new knowledge-based or IT-based economy), we may question whether the Hong Kong government will soon face a new budgetary environment. Determining the Hong Kong government's structural deficit at such an early stage would involve many highly subjective predictions of future changes in revenue, (e.g., whether land premium will return to its pre-collapse level).

Instead of offering my personal view on this issue without first conducting a careful analysis, the modest contribution I hope to make here is to highlight other interesting macroeconomic issues I have identified from the above facts and figures.

Prudent Fiscal Management in an Economy with Huge ReservesIn Hong Kong in 1997, fiscal reserves increased enormously. Thanks to the transfer of the Land Fund, which amounted to HK$200 billion, the Hong Kong government is now enjoying fiscal reserves of more than HK$400 billion. As a result, the 1999/2000 budget was blessed by a substantial increase in investment income from fiscal reserves, which offset the combined decline in salaries and profit taxes and land premium. Without this boost, Hong Kong might have run up a very large deficit. Moreover, because of the abundant fiscal reserves, investment income is likely to remain a major contributor to Hong Kong's revenue in the next few years, even though the average rate of return may fluctuate from year to year.

1. Costs and Benefits of Accumulating Fiscal Reserves

Being in possession of a large fiscal reserve helps us cope effectively with unforeseen crises that may have adverse effects on the government budget. During such crises, fiscal reserves allow the government the option of retaining existing spending programs without raising taxes. But there are opportunity costs associated with maintaining huge fiscal reserves, since the government cannot use these resources for the benefit of its citizens.

Given the fact that our fiscal reserves are sufficient to finance our government expenditure for almost two entire years, it may be useful to think about what prudent fiscal management means from a macroeconomic perspective. In order to communicate the idea underlying this concept without burdening readers with unnecessarily complicated analysis, I will make some simplifying assumptions and explain the idea using two steps.

First, it seems clear that there is a trade-off between the costs and benefits of maintaining fiscal reserves and that there is an optimal level of fiscal reserves that any given economy should retain in a particular year. Taking into account the fact that the Hong Kong economy is growing, maintaining an unchanging level of fiscal reserves may not be optimal. The objective in this case is to determine an optimal fiscal-reserves-to-GDP ratio. This is because a larger economy requires more fiscal reserves for rainy days.

In his 1998 budget speech, Mr. Donald Tsang suggested that fiscal reserves should be between 75% and 125% of the sum of annual government expenditure and the stock of the M1 definition of money supply. Assuming that government spending is proportional to GDP in the long run (which is roughly consistent with the pattern shown in Figure 2) and that money supply is proportional to nominal GDP in the long run, following the guidelines outlined above is similar to specifying a range of desirable fiscal-reserves-to-GDP ratios. Moreover, using 1998 data, we can see that the range is about 26% to 44%, with a mid value of 35%. Thus, one may interpret the policy guidelines described above as targeting the fiscal-reserves-to-GDP ratio at 35%, allowing the ratio to fall to as low as 26% in bad times and to rise to as high as 44% in good times.

The remaining analysis focuses on an issue regarding fiscal reserves that is associated with these guidelines, namely, whether the above-mentioned guidelines are consistent with another fiscal principle of balancing the budget (over a cycle). To illustrate the main idea as simply as possible, I abstract from the business cycle effect in the following analysis and consider the following question: Is balancing the budget consistent with the objective of maintaining a constant (e.g., a 35%) fiscal-reserves-to GDP ratio?

2. Implications of Balancing the Government Budget

To examine how balancing the budget over a business cycle fits into the framework of prudent fiscal management, let us start by describing some useful relationships relating to the government budget. Equations (1) and (2) clearly demonstrate the intertemporal nature of government budgets.

FRt - FRt-1 = rtFRt-1 + (Rt - Gt) (1) and

(2) where FRt is the fiscal reserves at the end of year t, Rt is government revenue (excluding investment income from fiscal reserves) at year t, Gt is government spending at year t, rt is the average rate of return of investment from fiscal reserves at year t, Yt is the GDP of the economy at year t, and gt is the growth rate of the economy at year t. While these equations are expressed in real terms in most applications, for convenience, I have chosen to express them in nominal terms in the following analysis.

The change in fiscal reserves, (i.e., the left-hand side of Equation (1), is equal to investment income plus other revenues minus expenditure. Investment income is equal to the average rate of return (r) times the level of fiscal reserves in the previous year. Equation (1) brings out two definitions of budget surplus that are interesting from both an economic and a policy perspective. They are

Zero headline surplus, which means that total expenditure is equal to total revenue, including investment income from fiscal reserves. (This type of surplus is commonly reported by the media, and that is why it is called headline surplus.)

Zero primary surplus, which means that total expenditure is equal to revenue, excluding investment income from fiscal reserves.

The concept of primary surplus is used in many industrial countries (such as the United States and the United Kingdom) with respect to debt issues. In those countries, fiscal reserve is negative when the government's net debt is positive. Let me emphasize that for countries whose fiscal reserves are relatively small, the difference between headline and primary surpluses is not so significant. But in the case of Hong Kong now, this difference is substantial.

Deriving from the first equation, the second equation tells us that the change in the ratio of fiscal reserves to GDP, the left-hand side of Equation (2), is determined by two factors. The first factor depends on the ratio of fiscal reserves to GDP in the previous year and the difference between the rate of returns on investment (r) and the growth rate of the economy (g). The second factor is the primary surplus to GDP ratio in the current year.

Our readers are probably more interested in the use of these equations than in the equations per se. So let me turn to a discussion of what the equations mean, particularly in relation to prudent fiscal management.

A frequently mentioned fiscal principle in Hong Kong is that of balancing the government budget over a business cycle. If this principle is to be interpreted as running a balanced headline budget (over a cycle), Equation (1) shows that fiscal reserves can be maintained at a roughly constant level. But Equation (2) shows that the fiscal-reserves-to-GDP ratio will fall over time for a growing economy such as Hong Kong's. On the other hand, Equation (2) tells us that if the government strives to maintain a zero primary surplus, the fiscal-reserves-to-GDP ratio will rise, provided that on average the rate of return of investment is greater than the growth rate of the economy, which is generally the case.

The analysis outlined above shows that in either case, if the policy target were simply to maintain a budget balance, the fiscal-reserves-to-GDP ratio would change over time, unless the existing fiscal reserves to GDP ratio were close to zero. But the current fiscal-reserves-to-GDP ratio in Hong Kong is far from zero. In the first case, where zero headline surplus is maintained, the government will use up the investment income from fiscal reserves to support spending, and it will not be possible to use this income for further reserve-accumulation purposes. As a result, the fiscal-reserves-to-GDP ratio may decline over time, which means that the government will be less able to cope with potential financial crises. In the second case, maintaining a zero primary surplus may be considered prudent, but it implies a huge opportunity cost, because it sacrifices any possibility of alternative use of the resources to improve the welfare of citizens.

To summarize, the aims of maintaining a constant fiscal-reserves-to-GDP ratio and balancing the government budget may not be consistent with each other.

SummaryBecause of Hong Kong's enormous fiscal reserves, investment income has contributed significantly to government revenue. As a result, our primary budget deficits were HK$62 billion in 1998/99 and HK$32 billion in 1999/2000, but headline surpluses and/or deficits were relatively small. Investment income from fiscal reserves will remain significant in the coming years.

Hong Kong's huge fiscal reserves raise a number of issues related to prudent fiscal management. In this paper, I have examined these issues from the viewpoint of macroeconomic principles. The analysis presented here suggests that a useful indicator of fiscal policy is the movement of the fiscal-reserves-to-GDP ratio over time. Moreover, if allowing the fiscal-reserves-to-GDP ratio to fluctuate around a constant level (over a business cycle) is a policy indicator for the health of our fiscal system, then simply focusing on balancing the government budget (over a cycle) may not be the best way to pursue prudent fiscal management. Perhaps both policymakers and citizens need to think more deeply about the costs and benefits of accumulating fiscal reserves and about what the optimal range of fiscal-reserves-to-GDP-ratios is.

Finally, I want to mention that many industrial countries have debt problems and discuss optimal debt policy. Hong Kong, on the other hand, is fortunate to be able to think about the opposite problem: how to best use accumulated fiscal reserves. My hope is that we will make good use of this opportunity to build a better future for current generations as well as for generations to come.

| Index | Research Projects | HKCER Letters |

| Speaker Program / Conference | Index of Economic Freedom |The Hong Kong Centre for Economic Research

School of Economics and Finance

The University of Hong Kong

Phone: (852) 2547-8313 Fax: (852) 2548-6319

email: hkcer@econ.hku.hk